Our New Blog

How you can increase your Profit by using One Hour to STRATEGICALLY REDUCE YOUR OVERHEAD COSTS. In this video, I am going to share with you how you can do it. We do this by finding ways to get better value, not just cutting costs. So, it’s not just about moving to a cheaper office and letting three people go without analysing the risks and benefits of doing so, it’s about working out the best plan.

This video will cover:

✅ what are overhead costs

✅ how to calculate overhead costs

✅ No. 1 tip to increase profits is to review your costs thoroughly

✅ My secret REVEALED on how we increase Profit in one hour … and so much more!

Reducing your Overhead Costs can have a significant positive impact on your small business

If you are in business, you have bills and costs that can build up. The costs you incur can be grouped into two types; the first type is known as direct costs, which are costs related to producing or creating products and services. The second type of costs you have, which are not associated directly with building a product or service, are known as overhead or indirect costs. If you aren’t careful, overhead costs can quickly become a significant drain on your revenue.

So our #1 tip to increase your profits is to review your costs thoroughly; therefore, you will want to take the time to figure out how to calculate overhead costs to benchmark your business costs. Once you figure the percentage of sales your overhead costs are, you will know if you need to reduce costs based on that comparison against known business benchmarks.

So, the big question is, what are overhead costs?

Overhead costs are those costs that are associated with running your business but that you can’t directly attribute to a:

- Service

- Product

- A portion of the company’s income

These indirect costs (overhead costs) include things such as:

- Admin costs

- Rent

- Insurances

- Utilities

- Office equipment

- Professional expenses

- Depreciation

Everyone has overhead costs in a business that don’t lead to generating profits. Additionally, overhead costs tend to be fixed. For instance, your rent payment tends to stay the same month to month, so fixed costs are typically overhead.

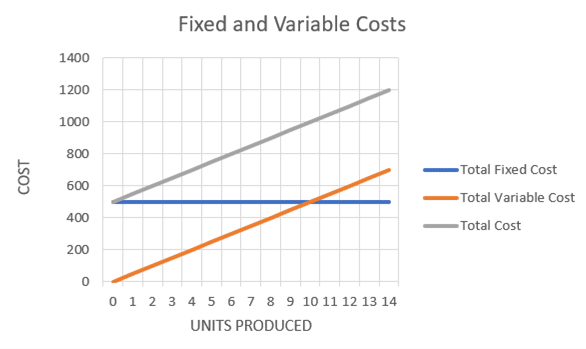

Overhead costs are different from direct costs. Direct costs, which include direct labour and direct materials, are associated with creating a product or service. Direct costs are also known as variable costs, and by adding direct costs and overhead costs to the income statement, you’ll see the total costs for your business. Direct costs are variable costs that increase in line with the more sales or products you sell. The classic direct costs (fixed costs) vs indirect costs (variable costs) graph is shown below and makes this concept easier to understand. You can see in this case that with more units produced, the fixed costs (overhead costs / indirect costs) stay at the same level irrespective of how many units are produced, whereas the variable costs increase (direct costs) the more units are produced.

How to calculate overhead costs

The most common way to calculate overhead costs is as a percentage of sales or labour costs.

It would be best if you aimed to keep your overhead proportion as low as possible. A small overhead proportion means that a high percentage of your expenses go directly toward producing a good or service. This lower overhead ratio will provide you with a competitive advantage.

A low overhead rate will allow you to;

- Better price your products, making you a more attractive option than your competition.

- Allow you to increase your profit margins, boosting your bottom line.

To calculate business overhead, you’ll need to first run through every specific business activity, listing all of your expenses. You’ll want your list to be thorough. Look through your financial statements to ensure that you pinpoint each one of your costs. Once you’ve identified all of your business expenses, you’ll want to sort them into two categories: direct and indirect expenses. When doing so, ask yourself, “Does this expense result in producing a good or service?”

Once all costs are correctly classified, you can figure out your business’s overhead rate as a percentage of sales. This is done by adding up all overhead costs, breaking them down by month, and then dividing that total by your total monthly sales. The formula is below:

(Overhead ÷ monthly sales) x 100 = overhead percentage

If your business has $280,000 in monthly overhead costs and $800,000 in monthly sales, divide $280,000 by $800,000, which gives you 0.35, multiply that by 100, and your get obtain your overhead percentage is 35% of your sales. This means that for every dollar the company makes, 35 cents goes to pay overhead. When you consider that the average profit margin for most companies is 10% or less, 35% is a very significant percentage that you would want to reduce. So you can see why it’s essential to have an eagle eye on your overhead costs as really you want to be at 30% or less for your overhead.

Calculating your overhead percentage in relation to labour cost is also beneficial. This is called the overhead allocation rate. The formula is as follows:

Total overhead ÷ total labour hours = overhead allocation rate

If your company had 900 labour hours per month, you would

divide $280,000 by 900 to get $311.11. This means that for every hour spent

consulting, your company needs to allocate $311.11 to overhead.

In both these cases, the lower the overhead percentage, the

more effective your business is at using its resources. And ideally, you want

your overhead cost to be less than 30% of your sales.

How to lower overhead your costs

If you look at your business finances and realise that overhead expenses are eating up a significant amount of your revenue, it may be time for you to re-evaluate. We will look at eight ways to reduce your overhead costs.

1. Review everything thoroughly

The first time you pull out your overhead costs, you’ll determine which expenses you can consider indirect. However, these expenses could fluctuate over time based on the activity level of your company. You should review overhead costs monthly to ensure no drastic changes. Furthermore, it would help if you poured through your list of business expenses each month. You should mark items that are:

- No longer necessary

- Too high in price

- Open to efficiencies

It’s always a good idea to get a handle on your costs before you try to make sweeping changes. Consider cutting back on some of your expenses to see how they impact your overhead costs.

2. Control your purchasing to gain efficiencies and cost reductions

If possible, utilise one person in your team to look after all purchasing. This person would be thrifty, have excellent negotiating skills, and be good at asking for a discount. Our favourites are;

- If we pay the total balance in eight months instead of 12, can we get a 3% discount?

- If we pay you every two weeks instead of monthly, can we get a 2% discount?

By putting one of your team in charge of purchasing, this person can dedicate their time solely to finding the best prices and bargains.

3. Clean out your office storeroom

There’s a chance that your storage room or empty office space is filled with non-working or old Computers, printers, fax machines, and phones, and you should get rid of these things by selling them. Take time to review your technology expenses and cut out those you no longer need, e.g. Software people don’t use much.

4. Review your current contracts

If you rent equipment or pay service retainer fees, you can find cost savings by evaluating your current deals to see if they still fit your needs. The evaluation process is especially crucial if the contracts are older. Chances are your business has changed since you first signed the contract, so it’s worth looking into the contract again.

5. Assess your team’s performance

Keeping employees who constantly underperform is a drain on your resources and employee morale. Removing someone from your team who isn’t a right fit could allow other members to work more efficiently, and getting the wrong people off the bus is just as crucial as getting the right people on the bus.

6. Leverage your current client base to save on promotions

Word-of-mouth is still the best form of referral to get new work. Consider reducing your advertising and marketing budget by leveraging your current, happy customers as your business brand Ambassadors. E.g. use google reviews to build your business reputation by asking clients for a testimonial they can add to your google review listing that you can also add to your website.

7. Go digital and paperless

Cut back on how much printing you do; most people mark up PDFs in a collaborative environment online, so there is little need to print. Back up all of your documents to the cloud or a drive, and document destroy any unnecessary files so that you don’t have costs related to document storage.

8. Optimise your Office space

Depending on your team’s size, it might be time to give up some of your office space and maybe move to a work-from-home model. Are you paying rent for a high-priced office in the middle of the city compared with others in your industry who have offices in the suburbs or have moved to work from home? If so, consider downsizing or maybe look into shared coworking spaces. WeWork is very successful because they offer an excellent environment for your team to work in.

Summary

Keeping costs down should be a year-round effort, and there should be a method to your cost-cutting. Make sure to take the time to learn more about where not to cut corners regarding your business finances. It would be best if you also utilised accounting software designed for small business owners. Xero can track direct and indirect expenses quickly. Doing so will allow you to identify your overhead ratio and develop a strategy to reduce costs.

When you price your products or services, you should consider the inventory cost or the labour and materials that go into them. Usually, it’s pretty clear what those are. But it would be a mistake to look at those costs and add markup. You also have to include your overhead costs in your pricing. Not knowing your overhead costs could result in pricing your products too low and not making a profit. Or, you might price them too high, resulting in unsold inventory and a hit to your bottom line.

Know your bare minimum revenue to stay in business

As overhead costs generally have to be paid monthly, you need to know your total minimum monthly cost and how much you need to earn to stay in business. You won’t operate for long when your revenue is below your costs as the old story of cash flow is King will kick in. With no cash flow (even if you have a great business opportunity), you will be out of business soon.

How to track overhead costs

With good accounting software like Xero, tracking your overhead costs is easy. Although most overhead costs are fixed, your business may also have variable overhead costs, such as shipping or office supplies. These costs can change from month to month. You may also have semi-variable costs, such as utility bills that change with the seasons, sales salaries where a commission is variable, and overtime costs.

You may find it helpful to split overhead costs into further subcategories: e.g. manufacturing and administrative. The benefit of this is that it allows you to allocate your manufacturing costs to works in progress or finished products. By separating overhead manufacturing costs, you can conduct a more thorough examination of your profitability, and this will give you more levers to pull and push to adjust your total overhead costs.

For example, administrative costs can’t be easily adjusted without significant changes to your business’s infrastructure (i.e., reducing your workforce). Consider off-shoring tasks that can be completed for less in a different country. Your manufacturing overhead could be adjusted by being proactive with maintenance to avoid repair costs.

There's no getting around Overhead Costs

While overhead costs are part of “the cost of doing business,” you can’t afford to overlook them. Getting a handle on your overhead costs shows what your cash flow needs to be and where your overall financial position wants to be. Knowing this helps you set prices optimally, see where there may be opportunities to cut costs and make better business decisions overall.

Cutting your Overhead Costs is by far the easiest thing you can do to boost your profits, and it's always the thing that we tell our clients to look at first.

This Is Why It's Our